Finding the Right Heart Specialist Who Accepts Your Insurance

When it comes to heart health, finding a qualified specialist is crucial. But when you’re trying to find a cardiologist who accepts your insurance, the process can be frustrating. I’ve been there myself—navigating through the confusion of insurance networks, doctor availability, and getting the proper care can be a daunting task. Here’s what I’ve learned through personal experience and research about how to find heart specialists who accept insurance in the U.S.

1. Understand Your Insurance Coverage

The first step in finding a heart specialist who accepts your insurance is understanding your insurance coverage. Most health insurance plans, whether through employers, government programs, or private insurers, have a network of approved providers. It’s important to know if your insurance plan is an HMO, PPO, or something else, as this will determine which doctors are covered and what your out-of-pocket costs will be. If you're unsure, calling your insurance provider for clarification is always a good idea.

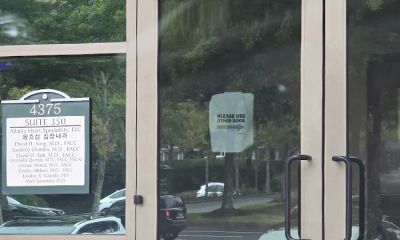

Atlanta Heart Specialists

atlanta heart specialists

4375 Johns Creek Pkwy #350, Suwanee, GA 30024, USA

2. Use Your Insurance Provider’s Directory

Once you have a solid understanding of your insurance, the next step is to use your insurance provider's directory to find cardiologists who are in-network. Most insurance companies have an online tool that allows you to search for doctors based on location, specialty, and whether or not they accept your insurance. This can be a great starting point, but don’t stop there. It’s always a good idea to double-check by calling the doctor’s office directly to confirm that they still accept your plan.

3. Search for Cardiologists Who Specialize in Your Condition

Heart specialists come in various forms. There are general cardiologists who treat a wide range of heart conditions, as well as specialists like electrophysiologists, interventional cardiologists, and heart failure specialists. Knowing your specific heart health needs will help you narrow down your options. If you need a specific type of care, be sure to look for a cardiologist with the necessary expertise.

4. Ask for Referrals from Your Primary Care Doctor

Another excellent way to find a heart specialist who accepts insurance is by asking for a referral from your primary care doctor. Your primary care doctor likely has relationships with cardiologists in your area and can provide recommendations based on your health needs. They can also ensure that the cardiologist they recommend accepts your insurance and is in-network.

5. Consider Location and Accessibility

When choosing a heart specialist, location and accessibility are key. You want to ensure that the cardiologist you choose is conveniently located, whether it’s close to your home or work. Accessibility is also important—make sure that the cardiology office has flexible hours, especially if you have a busy schedule or need urgent care. The last thing you want is to be stuck with an inconvenient appointment time or have difficulty scheduling follow-ups.

6. Check Reviews and Reputation

Once you’ve narrowed down a list of potential heart specialists, it's time to dig deeper. Checking online reviews, asking for recommendations from friends or family, or reading about the doctor’s reputation in medical directories can help. Look for doctors who are well-reviewed and who have experience with your specific condition. A doctor’s bedside manner and ability to explain treatment options are just as important as their qualifications.

7. Contact the Doctor’s Office to Confirm Insurance Acceptance

After finding a few potential cardiologists, the next step is to reach out to their office directly to confirm they accept your insurance. Even if your insurance provider’s directory lists them as in-network, insurance coverage can change. It’s always better to confirm in advance to avoid any surprises when it’s time to pay the bill. I’ve found that medical office staff are generally very helpful and will provide the most up-to-date information.

8. Understand Your Financial Responsibility

Even if you find a cardiologist who accepts your insurance, it’s important to understand your potential financial responsibility. Will you need to pay a co-pay? Does your insurance require prior authorization? What are your out-of-pocket costs if additional tests or treatments are needed? Being clear on these financial details before you visit can save you from unexpected bills later.

9. Explore Telemedicine Options

In today’s world, telemedicine has become an increasingly popular option, especially for those who have difficulty accessing in-person care. Some heart specialists offer virtual consultations, which can be convenient and time-saving. If your insurance covers telemedicine visits, this could be a viable option for getting expert advice from the comfort of your home.

10. Keep Track of Your Visits and Insurance Claims

Once you’ve found a heart specialist, keeping track of your visits and insurance claims is essential. Ensure that your insurance provider is billed correctly for your visit and that you’re not overcharged for any services. If there are discrepancies, don’t hesitate to contact your insurance provider or the doctor’s office to resolve the issue.

Real-Life Experience: My Journey to Finding the Right Heart Specialist

Let me share a personal experience. A few years ago, I started experiencing unusual chest pains, and my doctor recommended I see a cardiologist. I was initially overwhelmed by the process of finding a specialist who accepted my insurance. I spent hours on the phone, navigating insurance websites, and asking for referrals from my primary care doctor. After some trial and error, I finally found a cardiologist who not only accepted my insurance but also made me feel comfortable and heard during my appointments. It was a long road, but I felt confident that I had the right care.

Conclusion

Finding a heart specialist who accepts your insurance doesn’t have to be a stressful process. With the right tools, resources, and a little patience, you can secure the care you need. Remember to research, ask questions, and confirm your insurance coverage before making any appointments. By following these steps, you’ll be well on your way to receiving the best heart care without the added financial worry.

Deborah Heart and Lung Center

deborah heart and lung center

200 Trenton Rd, Browns Mills, NJ 08015, USA