Insurance Coverage for Genetic Testing in Heart Disease

Genetic testing has become a significant tool in the fight against heart disease, helping healthcare providers assess an individual's risk and personalize treatments. However, with medical costs rising, many patients are left wondering whether insurance will cover genetic testing for heart disease. As a vital resource in diagnosing and preventing cardiovascular disease, understanding the financial aspects of genetic testing is crucial. In this article, we’ll dive into the insurance coverage for genetic testing in heart disease, the factors influencing coverage, and the steps you can take to ensure access to this life-saving service.

1. The Importance of Genetic Testing in Heart Disease

Heart disease is one of the leading causes of death worldwide, and understanding the genetic factors contributing to cardiovascular risk is critical. Genetic testing can identify hereditary conditions like familial hypercholesterolemia, which causes high cholesterol levels and increases the risk of early heart disease. Additionally, genetic tests can help determine how a patient’s body will respond to specific medications, enabling doctors to create personalized treatment plans.

For instance, if a genetic test identifies a mutation that increases the risk of heart disease, doctors can start early interventions like lifestyle changes, medications, or regular screenings. The ability to predict these conditions and tailor treatments has revolutionized the prevention and management of heart disease.

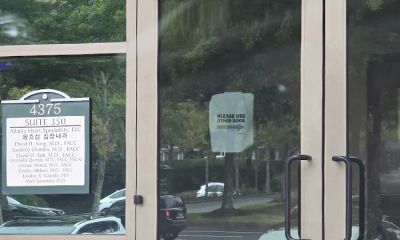

Atlanta Heart Specialists

atlanta heart specialists

4375 Johns Creek Pkwy #350, Suwanee, GA 30024, USA

2. Does Insurance Cover Genetic Testing for Heart Disease?

One of the most common questions patients have about genetic testing for heart disease is whether insurance will cover the cost. The answer varies depending on several factors, including the type of genetic test, the insurance provider, and the patient’s medical history. Generally, health insurance plans are more likely to cover genetic testing if it is deemed medically necessary and if it aligns with the guidelines established by the insurer.

For example, if you have a family history of heart disease or genetic mutations associated with cardiovascular conditions, your doctor may recommend genetic testing. In such cases, insurance companies are more likely to approve the test because it helps prevent more severe health problems and aligns with their coverage policies for preventive care.

3. Types of Genetic Tests for Heart Disease

Several types of genetic tests can help identify risks for heart disease, each serving a different purpose in the diagnostic process. Here are some of the most common tests:

3.1. Lipid Gene Panels

Lipid gene panels are used to measure the levels of cholesterol and other fats in the blood. These tests can identify mutations that affect lipid metabolism, such as familial hypercholesterolemia. This genetic disorder leads to dangerously high cholesterol levels, increasing the risk of early-onset heart disease.

3.2. Cardiomyopathy Testing

Genetic tests for cardiomyopathies help identify mutations linked to diseases of the heart muscle. Conditions like hypertrophic cardiomyopathy (HCM) and dilated cardiomyopathy (DCM) are inherited and can lead to heart failure, arrhythmias, and even sudden cardiac death. Identifying these genes early can lead to life-saving interventions.

3.3. Pharmacogenomic Testing

Pharmacogenomic testing helps determine how a patient’s genetic makeup will influence their response to medications. This test is particularly useful in heart disease treatment, as it allows doctors to prescribe the most effective drugs based on the individual’s genetic profile, reducing side effects and improving outcomes.

4. Factors That Affect Insurance Coverage for Genetic Testing

While genetic testing for heart disease is invaluable, several factors influence whether your insurance will cover the cost. These include:

4.1. Medical Necessity

Most insurance companies will only cover genetic testing if it is considered medically necessary. If your healthcare provider can demonstrate that the test will provide valuable information for diagnosing or treating a specific condition, there is a higher chance of coverage. This means that tests done purely for curiosity or without a relevant medical condition may not be covered.

4.2. Insurance Plan Type

The type of insurance plan you have also impacts coverage. Government-funded plans like Medicare and Medicaid may have different rules for genetic testing compared to private insurance plans. Additionally, if you have a high-deductible health plan (HDHP), you may need to meet your deductible before insurance will cover the cost of genetic testing.

4.3. The Specific Genetic Test

Some genetic tests are more widely accepted by insurance companies than others. Tests with well-established guidelines and proven medical benefits are more likely to be covered. For example, tests related to conditions like familial hypercholesterolemia or known cardiovascular diseases may have higher chances of insurance approval.

5. How to Ensure Your Genetic Test Is Covered by Insurance

If you’re considering genetic testing for heart disease, it’s essential to take a proactive approach to ensure that your insurance will cover the cost. Here are a few steps you can take:

5.1. Check Your Insurance Policy

Start by reviewing your insurance policy or contacting your insurance provider to understand what’s covered. Policies can vary significantly, so it’s essential to know if genetic testing is included, and if so, under what circumstances.

5.2. Get a Referral from Your Doctor

Your doctor can help advocate for you by writing a letter of medical necessity. This letter should explain why genetic testing is essential for your health, citing any family history or medical conditions that make the test necessary. A well-documented referral increases the chances that your insurance will approve the test.

5.3. Appeal a Denied Claim

If your insurance denies coverage, don’t give up. You can appeal the decision. Often, a detailed explanation from your doctor and additional documentation can lead to the overturning of the decision. Be persistent and work with your healthcare provider to provide the necessary information for approval.

6. The Future of Insurance and Genetic Testing for Heart Disease

As genetic testing continues to play an increasingly important role in healthcare, many hope that insurance coverage for these tests will expand. The benefits of genetic testing for heart disease are clear—early detection, personalized treatment plans, and prevention of more severe complications. As the cost of genetic testing decreases and the technology improves, we can expect more insurers to recognize the value of these tests and offer better coverage options.

For now, it’s essential to stay informed, work closely with your healthcare provider, and be proactive in understanding your insurance options. By doing so, you can take advantage of the life-saving benefits that genetic testing offers, without facing financial hardship.

SEO Title: Insurance Coverage for Genetic Testing in Heart Disease SEO Keywords: genetic testing, heart disease, insurance coverage, genetic testing coverage, heart health, medical necessity SEO Description: Learn about the importance of genetic testing for heart disease, how insurance covers it, and what steps to take to ensure coverage. Get informed about insurance policies for genetic tests and how they can help prevent cardiovascular diseases.

Deborah Heart and Lung Center

deborah heart and lung center

200 Trenton Rd, Browns Mills, NJ 08015, USA